A lot of Americans, 64%, have trouble with budgets. That’s why Dave Ramsey’s zero based budgeting is so popular. It lets you control your money and decide how to spend it.

Zero based budgeting means every dollar has a job. This cuts down on waste and boosts savings. It’s a method that really works for people and families to manage their money and reach their goals.

Exploring zero based budgeting with Dave Ramsey shows its many benefits. It helps you find financial stability. You’ll make a budget that fits your life, not the other way around.

Key Takeaways

- Zero based budgeting dave ramsey helps you take control of your finances

- Every dollar has a purpose, reducing waste and increasing savings

- Zero based budgeting dave ramsey is a proven approach to managing finances

- This approach helps individuals and families achieve their financial goals

- Zero based budgeting dave ramsey creates a budget that works for you, not against you

- With zero based budgeting dave ramsey, you can make conscious decisions about your spending

What Is Zero-Based Budgeting Dave Ramsey Style?

Managing your money is key. A zero-based budget means every dollar has a job. Dave Ramsey made this popular. It helps you spend wisely and use your money well.

With a zero-based budget Dave Ramsey style, you use every dollar. This way, you don’t waste money. It helps you reach your financial goals.

- Reduced debt: You can pay off debts faster. This frees up money in your budget.

- Increased savings: Knowing your income and expenses helps you save more.

- Improved financial stability: A zero-based budget keeps you financially stable. It helps you handle money better.

Following Dave Ramsey’s zero-based budgeting helps you control your money. Every dollar has a purpose. This way, your money works for you, not against you.

The Benefits of Zero-Based Budget Planning

Zero based budgeting lets you control your money. You decide how to spend it. This way, you can focus on what’s important to you.

It also helps you save money. You can reach your long-term goals faster.

Some big benefits of zero based budgeting are:

- Increased financial control: You know exactly where your money goes. You can change things if needed.

- Reduced stress: You won’t be surprised by money issues. You’ll feel more secure about your money.

- Improved savings: You’ll save more because you know what to spend on first.

Using zero based budgeting means you make smart money choices. You spend less on things you don’t need. You save more for the future.

Zero based budgeting helps you make a budget that suits you. Always check and update your budget. This keeps you on track and makes changes easy.

Getting Started with Your Zero-Based Budget

To start your zero-based budget, remember every dollar has a job. Dave Ramsey says to first figure out your monthly income. This shows how much money you have to spend.

Then, list all your expenses. This includes rent, utilities, groceries, and fun stuff. Use a dave ramsey budget template to help. Common categories are:

- Housing

- Transportation

- Food

- Insurance

- Entertainment

By following these steps, you’ll manage your money better. Keep track of your spending. A zero-based budget helps you use your money wisely and reach your goals.

Starting a zero-based budget is tough at first. But, it gets easier with time. Stay consistent and patient. As you work on your dave ramsey budget, you’ll save money and grow your wealth.

| Category | Budgeted Amount | Actual Spending |

|---|---|---|

| Housing | $1,500 | $1,200 |

| Transportation | $500 | $450 |

| Food | $800 | $700 |

Essential Tools for Zero-Based Budgeting

Managing your money with a zero-based budget is easier with the right tools. You can pick digital or paper methods, based on what you like. Digital tools are easy to use and do math for you. Paper tools let you touch your budget and stay focused.

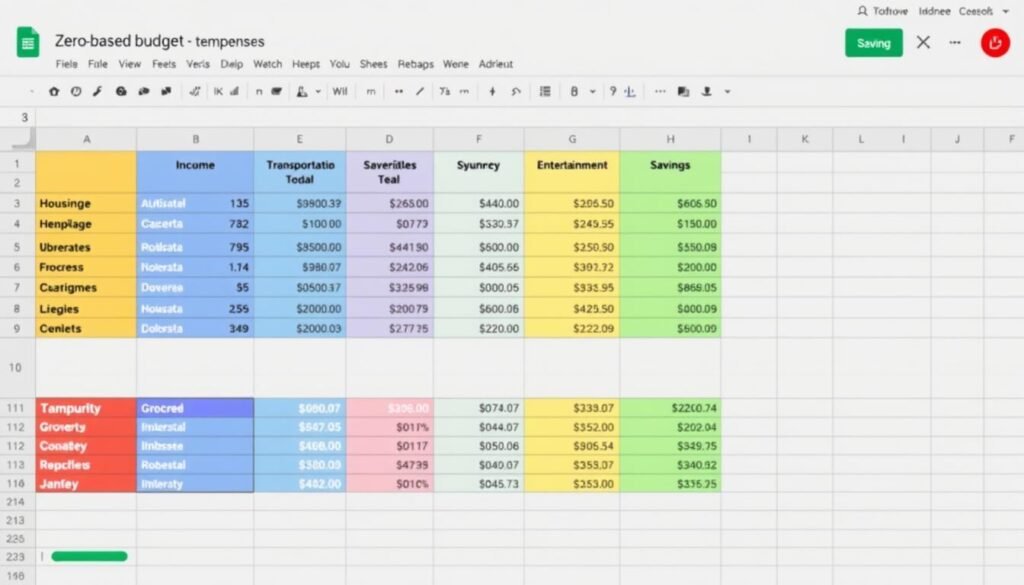

A zero-based budget template Google Sheets is a top choice. It lets you track your spending from anywhere. You can use it on your phone, tablet, or computer, making budget changes simple.

Digital vs. Paper Budgeting Methods

Digital tools like Mint and You Need a Budget (YNAB) are popular. They help you keep track of your money. Paper methods, like notebooks or spreadsheets, are simple and hands-on.

Recommended Apps and Spreadsheets

There are many apps and spreadsheets for managing money. Some favorites include:

- Microsoft Excel

- Google Sheets

- Mint

- YNAB

Using Zero-Based Budget Template Google Sheets

To start with a zero-based budget template Google Sheets, make a new spreadsheet. Set up columns for income and expenses. Use formulas to find your totals, and adjust your budget as needed.

Common Mistakes to Avoid in Zero-Based Budgeting

When you budget, accuracy and attention to detail are key. A big mistake is not guessing expenses right. Make sure to check your budget often to catch all costs. If you miss something, you might feel stressed and struggle with your budget.

To avoid these mistakes, here are some tips:

- Track your expenses to understand where your money is going

- Account for irregular expenses, such as car maintenance or property taxes

- Regularly review and adjust your budget as needed

Being proactive and flexible with your budget helps. This way, you can avoid common mistakes and reach your financial goals. Remember, budgeting needs regular work and adjustments to succeed.

Other mistakes include not knowing what’s a need versus a want. Also, not having an emergency fund is a big error. By avoiding these and sticking to your budget, you can find financial stability and success.

Zero-based budgeting is a powerful tool for taking control of your finances, but it requires discipline and attention to detail to be effective.

| Mistake | Solution |

|---|---|

| Underestimating expenses | Regularly review and adjust budget |

| Failing to account for irregular expenses | Track expenses and include irregular expenses in budget |

| Not regularly reviewing budget | Schedule regular budget reviews |

Making Adjustments to Your Budget

As you keep going on your financial journey, it’s key to check and tweak your budget often. This keeps you on track with your money goals. It also lets you adjust to use your money wisely.

To do a monthly budget check, start by tracking your money coming in and going out. This shows where you can save money. Try the 50/30/20 rule. Use 50% for needs, 30% for wants, and 20% for saving and paying off debt.

Monthly Budget Reviews

When you review your budget each month, look closely at your spending. See where you can save money. dave ramsey budgeting tips say to check your budget categories too. Make sure you’re not spending too much in any one area.

Handling Irregular Expenses

It’s hard to budget for unexpected costs like car repairs or taxes. To deal with these, save a little each month in a special account. This way, you won’t go into debt when these costs come up.

Emergency Fund Integration

An emergency fund is very important in your budget. It helps when you face unexpected bills or lose your job. Try to save 3-6 months’ worth of living costs in your emergency fund. This makes you ready for life’s surprises.

By following these steps and using dave ramsey budgeting tips, you’re on your way to financial stability. Stay flexible and adjust your budget as needed. This will help you reach your financial goals.

Success Stories and Real-Life Examples

Many people have found financial stability with zero based budgeting. These zero based budgeting success stories show how well it works. By planning every dollar, they control their money and reach their goals.

Some great zero based budgeting success stories include:

- Paying off debt: Many have cleared credit card debt, student loans, and other loans using zero based budgeting.

- Building savings: They save for emergencies, retirement, and other big goals by focusing on savings.

- Increasing income: Some have found ways to make more money, like getting a side job or more education.

These zero based budgeting success stories prove its power. It helps people achieve financial freedom. By using zero based budgeting, they make a budget that suits them and helps them reach their goals.

Conclusion: Taking Control of Your Financial Future

Zero-based budgeting, inspired by Dave Ramsey, can change your financial life. It helps you use every dollar for a specific goal. This way, you understand where your money goes and make better choices.

Budgeting is more than just numbers. It’s a way of life that changes how you see money. Be flexible with your budget and celebrate every win. With hard work and dedication, you’ll reach your financial dreams.

Start your journey by making a zero-based budget that’s just for you. Look for tools and advice from experts. Your financial freedom is close, and it begins with one step.

FAQ

What is zero-based budgeting according to Dave Ramsey?

Zero-based budgeting, as Dave Ramsey teaches, means you plan where each dollar goes. You don’t just track spending. You decide before the month starts.

Why is the “every dollar has a job” principle important in zero-based budgeting?

The “every dollar has a job” idea is key in zero-based budgeting. It means you decide each dollar’s purpose before the month starts. This ensures your money goes to needs, debt, savings, and goals.

What are the key benefits of using a zero-based budget?

Zero-based budgeting helps you control money better, feel less stressed, save more, and pay off debt faster. By planning each dollar, your money works for you and meets your financial goals.

How do I get started with a zero-based budget?

Start by figuring out your monthly income and listing expenses. Then, set up budget categories. Using a zero-based budget template in Google Sheets can help track spending and meet financial duties.

What are some common mistakes to avoid in zero-based budgeting?

Avoid underestimating expenses and forgetting about irregular costs. Also, don’t skip budget reviews. Stay proactive, flexible, and committed to reach your financial goals.

How can I make adjustments to my zero-based budget?

Adjust your budget by regularly reviewing it, planning for irregular costs, and adding an emergency fund. Be flexible and update your budget as needed to match your financial goals.

Where can I find success stories and real-life examples of zero-based budgeting?

Look for success stories and examples on Dave Ramsey’s website, in his books, and podcasts. These stories can inspire and motivate you as you manage your finances with this method.

Your writing awakens the mind and softens the heart — a rare and powerful combination.