Are you tired of feeling overwhelmed by your finances? Do you dream of a life where money doesn’t dictate your every decision? You’re not alone. Millions of people struggle with managing their money, but the good news is that financial freedom is within your reach.

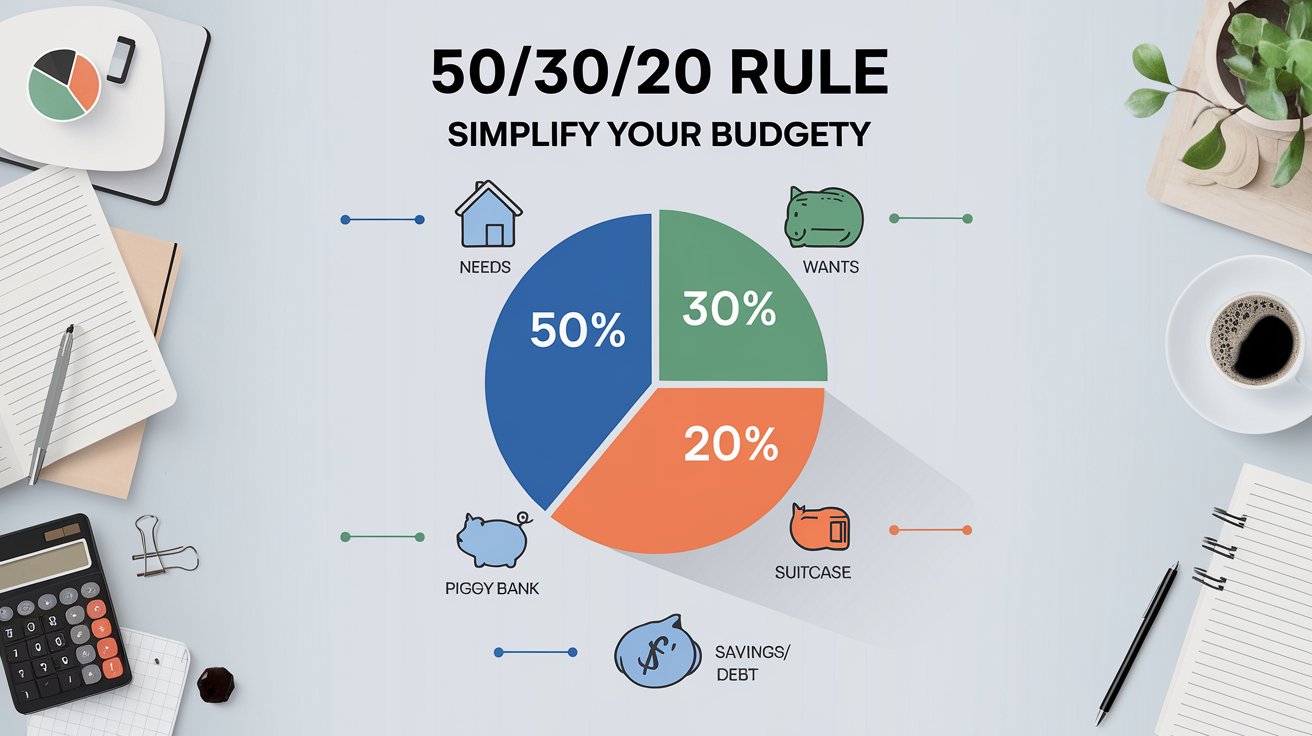

The 50/30/20 rule is a straightforward budgeting strategy that simplifies your financial life. In this guide, we’ll break down how this rule works, why it’s so effective, and how you can start using it today to take control of your finances and achieve your dreams.

By the end of this post, you’ll have a clear roadmap to transform your financial mindset and create a budgeting system that works for you. Let’s dive in!

What Is the 50/30/20 Rule?

The 50/30/20 rule is a simple budgeting method that helps you allocate your income into three categories:

50% for Needs: Essentials like housing, utilities, groceries, and transportation.

30% for Wants: Non-essentials that bring joy, such as dining out, entertainment, and hobbies.

20% for Savings and Debt Repayment: Building your financial future through savings and paying off debt.

This framework, popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, offers a practical way to manage your money without feeling restricted.

Why the 50/30/20 Rule Works

Simplicity Is Key

Complex budgeting systems can feel overwhelming, leading to frustration and burnout. The 50/30/20 rule is easy to understand and implement, making it a sustainable long-term solution.

Flexibility and Balance

Unlike rigid budgets, this rule allows room for enjoyment while prioritizing savings and needs. It’s not about depriving yourself—it’s about finding a healthy financial balance.

Builds a Strong Financial Mindset

By categorizing your expenses, you’re naturally encouraged to think critically about your spending habits and make more intentional choices. Over time, this cultivates a positive financial mindset.

How to Apply the 50/30/20 Rule to Your Life

Step 1: Calculate Your After-Tax Income

Start by determining your monthly income after taxes. This is the base amount you’ll allocate according to the rule. If you’re unsure, review your pay stubs or bank statements.

Step 2: Break Down Your Expenses

50% for Needs

Essentials should take up no more than half of your income. Examples include:

Rent or mortgage payments

Utility bills

Groceries

Transportation costs

Tip: If your needs exceed 50%, look for ways to reduce costs, like downsizing or switching to cheaper alternatives.

30% for Wants

This category is for non-essentials that enhance your quality of life:

Dining out

Streaming services

Vacations

Hobbies

Tip: Prioritize wants that bring genuine joy and align with your values.

20% for Savings and Debt Repayment

This portion is your ticket to financial freedom. Focus on:

Emergency savings

Retirement accounts

Paying off high-interest debt

Tip: Automate your savings to make this process effortless.

Step 3: Track and Adjust

Regularly review your spending to ensure you’re sticking to the 50/30/20 rule. Use budgeting tools or apps to simplify tracking. If you find yourself struggling in one category, adjust as needed.

Real-Life Example of the 50/30/20 Rule

Imagine you earn $4,000 per month after taxes. Here’s how your budget might look:

| Category | Percentage | Monthly Amount | Example Expenses |

|---|---|---|---|

| Needs | 50% | $2,000 | Rent, groceries, utilities |

| Wants | 30% | $1,200 | Dining out, hobbies |

| Savings/Debt | 20% | $800 | Emergency fund, loans |

Tips for Success with the 50/30/20 Rule

Start Small: If allocating 20% to savings feels daunting, begin with 5-10% and gradually increase.

Use Tools: Apps like Mint or YNAB can help you stick to the 50/30/20 rule effortlessly.

Reassess Regularly: Life changes, and so should your budget. Review your finances every six months.

Celebrate Wins: Hit a savings milestone? Treat yourself—responsibly—from your “Wants” category.

FAQ’s

1. Can the 50/30/20 Rule Work for Low-Income Earners?

Yes! While it may require adjustments, the principle of prioritizing needs, managing wants, and saving remains effective.

2. What If My Needs Exceed 50% of My Income?

If your needs take up more than half your income, look for ways to cut costs or increase your earnings through side hustles or skill-building.

3. How Does the 50/30/20 Rule Apply to Debt?

Focus on high-interest debt in the 20% category first. Once paid off, redirect those funds to savings.

4. Is This Rule Suitable for Freelancers or Variable Income Earners?

Absolutely. Use an average of your monthly income to create a baseline budget.

5. Should I Include Retirement Savings in the 20%?

Yes. Retirement savings are a crucial part of building long-term wealth.

Conclusion:

The 50/30/20 rule is more than just a budgeting strategy—it’s a pathway to financial freedom and peace of mind. By simplifying your finances and fostering a healthy financial mindset, this rule empowers you to achieve your goals while enjoying life along the way.

Start small, stay consistent, and remember: every step you take brings you closer to the life you dream of. Take action today by creating your budget, and don’t forget to revisit it regularly to stay on track.

Ready to transform your financial life? Share your journey in the comments below or explore more tips on our blog for achieving your money goals!